November Reflections

November tends to set the tone for the holiday season for me. You bet I already started watching Christmas movies! Some of my favorite Christmas movies include Elf, The Polar Express, How The Grinch Stole Christmas, and any other Holiday movie available on Netflix! Enjoying a cozy night in during the Holiday season helps with budget relief too. I do not have to worry about spending money going out to the movies, or eating out, because all of that can be done in the comfort of my home. I started my holiday baking too; by finding ingredients in my cupboard, searching those ingredients into Google, and making it my own by adjusting according to what I have on-hand.

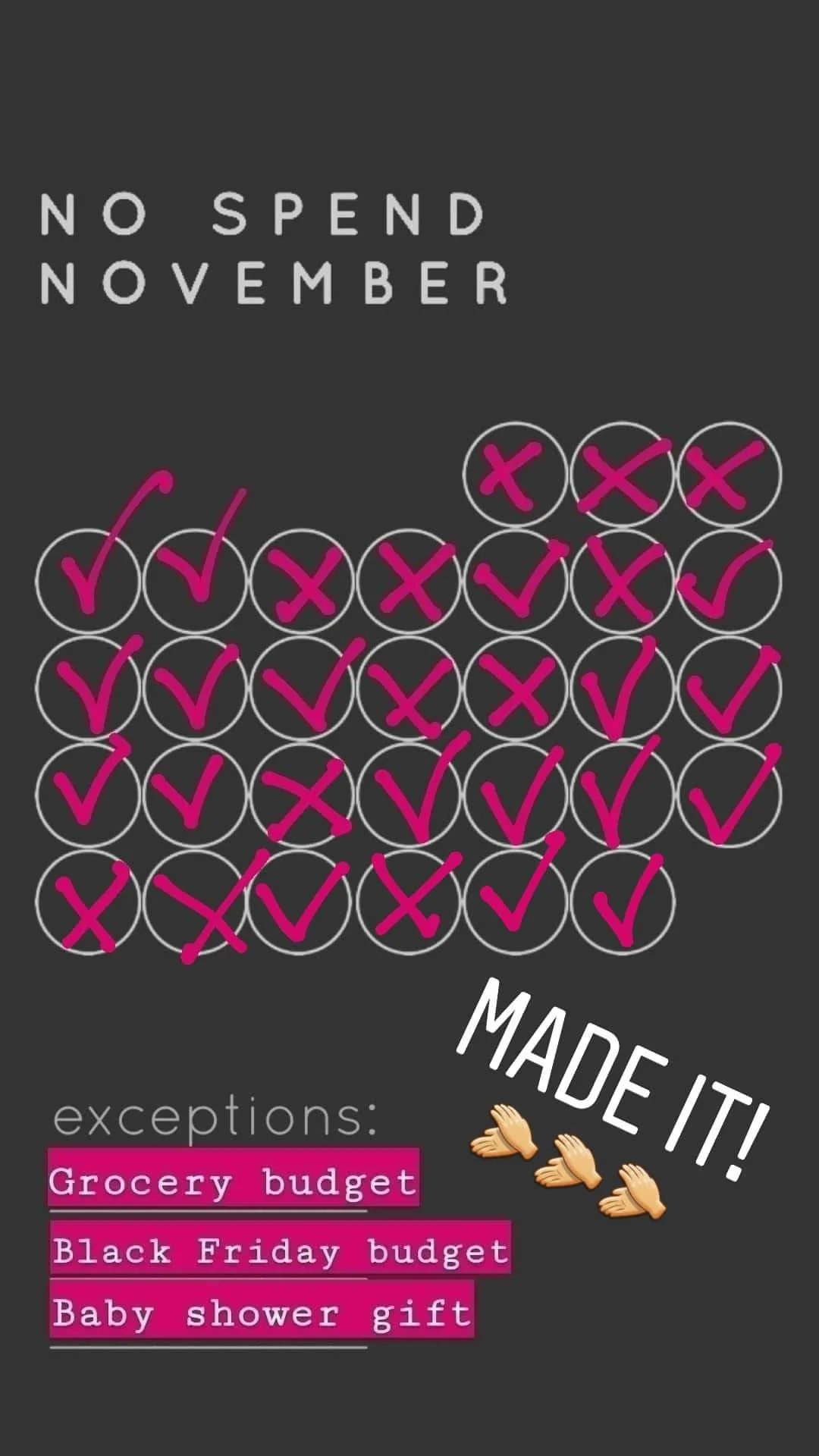

If you have been watching my Instagram Stories recently, then you are probably already aware that I have been watching my spending carefully on the daily. I had set-up 3 specific goals for the month of November. The point of my goals were to not really be excessive during this holiday season. I feel like throughout the Holiday seasons in the past I have allowed myself to be excessive. Over indulging in good food. Over indulging in buying Christmas presents. So, I made a pact with myself that I would not be excessive this Holiday Season. Here are the goals by which I measured this:

If I am going to spend money, I will choose to spend it on the cheapest/healthiest thing for me.

Opposite of that, I will do my best to have as many no-spend days in Novembers, as I can.

I will stick to my Black Friday line item budget, no overspending here.

November Goal 1: Cheap and Healthy

For the most part this goal really worked for me. Throughout the month of November I felt myself become more conscious about each purchase. I made sure that if I was going to buy something, even if it was a budgeted item, that it would be the cheapest I could find it. I had to rearrange a few things that I did order to make sure it was the cheapest and healthiest. But overall, this goal came fairly easy to me.

November Goal 2: No Spend November

For this goal, I was to keep track of my spending on the daily. I did not have a specific goal for the number of no-spend days, simply because I had not challenged myself like this in the past. Out of thirty days in November, I actually was able to have eighteen no-spend days - and I am calling that a win!

Once you become more conscious about how and when you spend money it brings more awareness to bad spending habits. Being more aware and mindful about spending every day is truly eye-opening. I mean, there were still many days where I felt tempted to spend money outside of my budget. But, the simple fact of sticking to this goal was helpful for me in becoming more aware and conscious of my spending habits.

November Goal 3: Stick to Black Friday Budget

I did my research, planning, and price checking before I even went in to Black Friday shopping on Thanksgiving Day. I had planned months in advance for the items that I was planning on buying. Since I had my list for what I was to buy on Amazon, all I needed to do was go into my cart and click on purchase! In fact, I had budgeted to buy a plane ticket for a trip I am taking next year. However, when I looked through my inbox at all the deals and sales the airlines were having, no matter what the deal, it still did not fit into the budget I had planned to spend. So, I decided to pass on buying the plane ticket during the Black Friday weekend and set up some Google alerts on plane tickets, so I will get notified once the price drops. This way, once I see the price fall into my budget then I will click on purchase. My trip is still a few months away, and I think I have the time and flexibility to do this.

Let me take a moment to mention how important it is to plan purchases out, especially if it is going to be a large purchase. If I was not being mindful about my specific budgeted amount for that plane ticket it is very likely I could have spent a hundred dollars more than I am actually willing to spend. Oftentimes, we have a tendency to get caught up in the busyness of the work day, and end up not being mindful about what happens once we leave work. For me, my weakness lies in thinking there is no harm in driving through Del Taco or In-N-Out for dinner after work. The thing is, each time I do that it adds more and more to my dining out budget line that was unplanned for. Which means the potential of that budget line increasing each month is high. This is why I am such an advocate of meal planning. Meal and grocery planning can save hundreds per month if you do it right!

One common thing I often overhear people talking about is when someone sees an item they would like to purchase, say In-N-Out on the way home from work, then that person tries to figure out how to fit that one item that they want into their budget. But that type of thinking is backwards. It should actually be the other way around. The budget and planning should have already been done prior to going into the store. If it is not in the budget at that moment, then perhaps it can be added to your budget later on if it is something you really want. So, the idea is that you would plan for it instead of making an impulse buy. My hope in saying this is so that we can be self aware and make conscious decisions rather than snap decisions. It honestly feels like it is a trap that we get pulled into of the need to overspend and over-indulge. May we all be a little more mindful this holiday season on purchases that we make and the food we choose to eat.

Blog Posts You Might Enjoy: