Hey Entrepreneur!

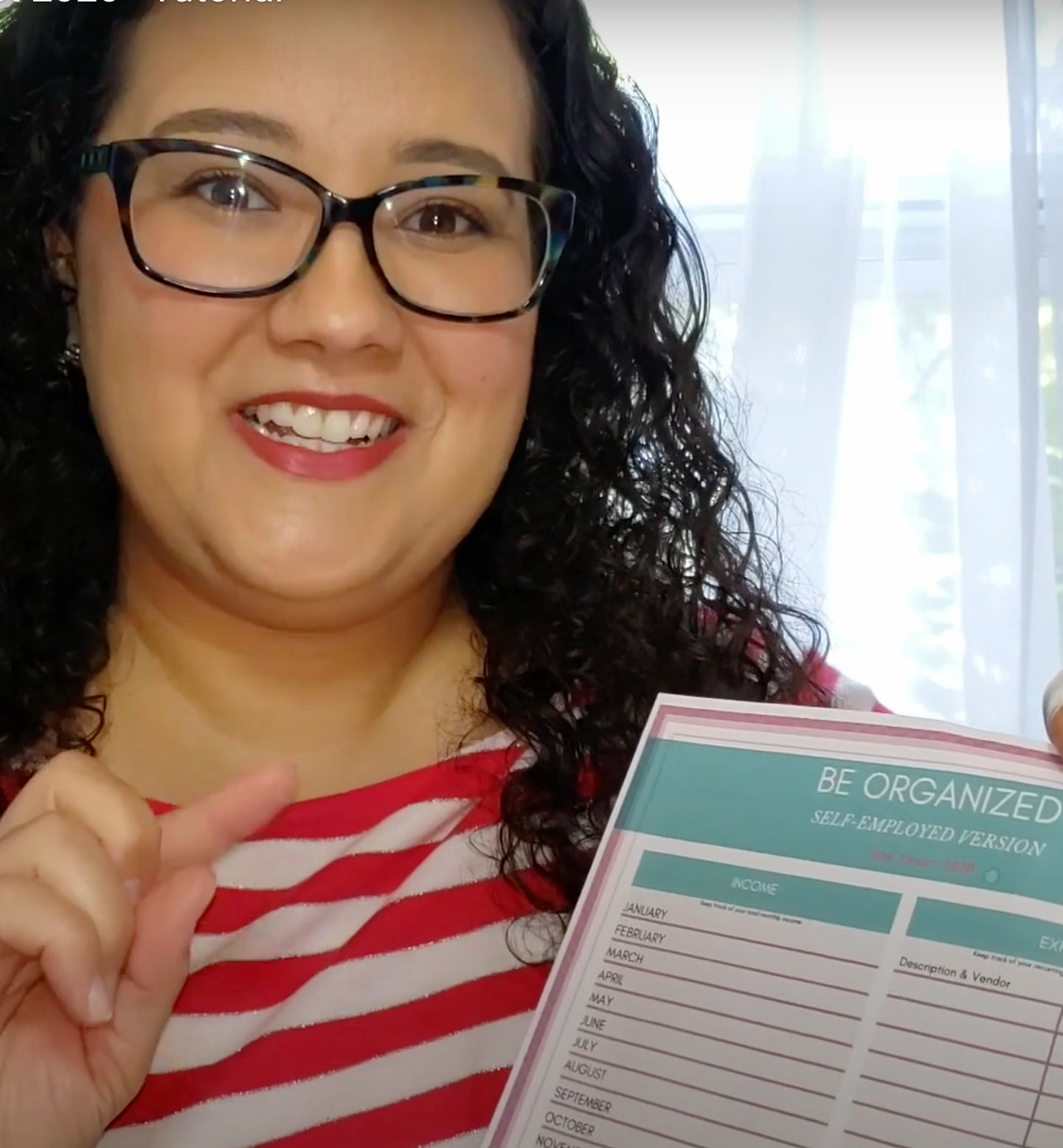

Get Your “Be Organized” Worksheet TODAY

Track Income, Expenses, Mileage, & Quarterly Taxes

Running a small business means wearing a lot of hats—bookkeeper, tax planner, and sometimes even accountant. Staying on top of your numbers can feel overwhelming, but it doesn’t have to be.

That’s why I created the FREE Be Organized Worksheet—a simple, printable, and beginner-friendly tool to help you track:

✅ Monthly Income & Expenses – Understand where your money comes from and where it goes.

✅ Mileage Log – Record every business trip for accurate IRS mileage deductions.

✅ Quarterly Estimated Taxes – Stay ahead of deadlines and avoid surprise tax bills.

With this worksheet, you’ll have one place to keep your finances organized and stress-free.

Why You Need This Expense Tracking Worksheet

Keeping your financial records organized isn’t just about taxes—it’s about running your business smarter.

Save time at tax season by having everything documented.

Maximize deductions with a mileage tracker that meets IRS requirements.

Manage cash flow by monitoring income and expenses monthly.

Reduce stress knowing your quarterly tax payments are planned for in advance.

Whether you’re a freelancer, consultant, or small business owner, this tool makes financial organization easy and approachable.

How to Get Started

Sign up for my weekly newsletter

Download the free worksheet (PDF format).

Save it digitally and/or print it—whichever you prefer.

Watch the YouTube video walkthrough on how to set it up in minutes.

Stay consistent each month and breathe easier when tax time comes.

Frequently Asked Questions

Is this worksheet really free?

Yes! It’s my way of helping fellow entrepreneurs stay organized. All you have to do is sign up for my weekly newsletter.

Do I need accounting software to use this?

Nope. This worksheet is simple, straightforward, and designed for anyone—no bookkeeping background required.

Can I use this for IRS mileage deductions?

Yes. The mileage log includes date, purpose, and miles traveled, which are the key details required for IRS compliance.